The undersigned hereby represents and warrants that the paper is original and that he/she is the author of the paper, except for material that is clearly identified as to its original source, with permission notices from the copyright owners where required.

The undersigned hereby transfers any and all rights in and to the paper including without limitation all copyrights to JBA and P3M STIE Trisakti. The copyright to this article is transferred to Jurnal Bisnis dan Akuntansi (JBA) and Pusat Penelitian dan Pengabdian kepada Masyarakat (P3M) Sekolah Tinggi Ilmu Ekonomi (STIE) Trisakti if and when the article is accepted for publication. The change of taxable income, causing the overpayment that the correction made directly from January to June and compensation to reduce taxes in July. PT X in the calculation and reporting of payroll and income tax artiin accordance with the method of gross-up can be seen from the SPT 1771 Board Annual annex I point 5 appears deferred admission fee. In reporting PT X there some reporting are delays. The result of this research is the calculation, payment, and tax reporting in 2015 by PT X is not in accordance with the tax regulations.

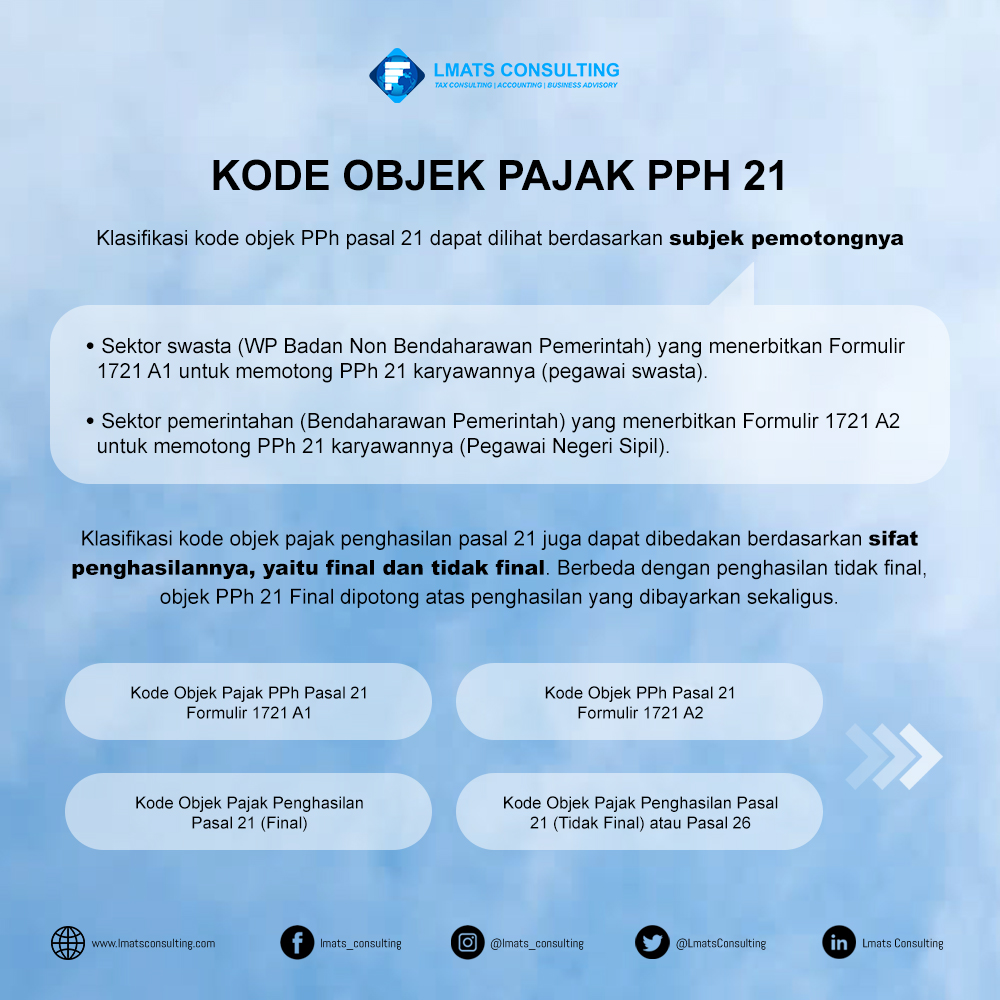

Descriptive analysis method used for this study, where the study is conducted by collecting data and information related to the calculation, payment, reporting, and recording of Income Tax Article 21. This study discusses the calculation, payment, reporting and recording of Income Tax Article 21 PT X and comparison calculations with PER 31 / PJ / 2012 and PER 32 / PJ / 2015. Data of this study consisted of payroll, list income tax calculation Article 21, SPT Masa PPh Article 21, the evidence reported Income Tax Article 21.

The study also compare the amount of income tax payable 21 PT X with PER 31 / PJ / 2012 and PER 32 / PJ / 2015 as a result of the change in taxable income. The purpose of this study is to analyze the suitability calculations, payment and reporting of Income Tax 21 made by the company with the tax regulations.

0 kommentar(er)

0 kommentar(er)